Marriage of European Shipyards Could Augur ‘Naval Airbus’

The long-awaited, much-needed consolidation of Europe’s fragmented naval industry — which some believe could one day lead to a ‘Naval Airbus’ — may be about to take its first step with the planned acquisition of France’s Saint-Nazaire yard by Italy’s Fincantieri.

The irony is that if the naval business is about to finally consolidate, in the wake of steps taken by the land and air sectors, it would be less due to years of urging from analysts and managers, and more due to a big shove given by the luxury cruise ship industry, not to mention the bankruptcy of a Korean ship builder.

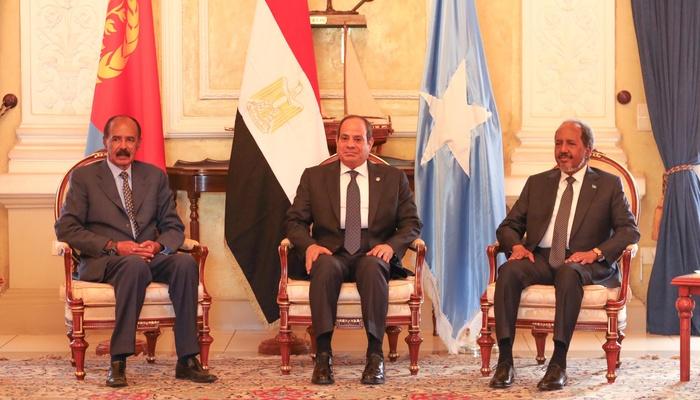

Fincantieri — Italy’s biggest naval ship manufacturer — is on course to take control this year from Korea’s STX of Saint-Nazaire, which recently built two Mistral helicopter carriers destined for Russia and later sold to Egypt, and is the only yard in continental Europe large enough to build an aircraft carrier.

The deal would be a coup for Fincantieri’s veteran CEO Giuseppe Bono, who said last year, “We must work together — Today there is competition between European firms but the competition should be between European firms and the rest of the world.”

Bono has pointed out how three European yards, Navantia, BAE and Fincantieri, are currently competing to sell frigates to Australia.

Adm. Matteo Bisceglie, Italy’s head of naval procurement, agreed, telling Defense News last week, “Industry cooperation in Europe, which is missing today, is the best way to sell naval and civil vessels to the world.”

Both Bono and Bisceglie were present in Rome in September at the presentation of a research paper which claimed European navies today cannot afford to build more than eight or ten frigates at a time. If firms teamed up, it argued, following the example of Airbus, as well as Germany’s KMW and France’s Nexter in the land sector, prices for ships would go down and more could be built.

The Centro Studi Internazionali, which published the research paper, said consolidation would be welcome news for the half-million employees of Europe’s shipyards.

Fincantieri’s Bono has been talking up European aggregation for years, and pushed hard for a European buy-out when the shipbuilding activity of Norway’s Aker came up for sale in 2008. To his chagrin, Korea’s STX was cleared for the purchase, although he was able to then buy the business from STX in 2012. When STX went bankrupt last year, Bono got in line again, becoming the preferred bidder earlier this month to buy out a 66.66 percent stake in the business unit STX France, the owner of the Saint-Nazaire yard. The remainder is controlled by the French government.Saint-Nazaire may build warships, but Bono’s prime objective is taking over the yard’s bulging, 12 billion Euro order book for luxury cruise ships — a line of business which is also currently thriving at Fincantieri.

The Italian yard is doing well out of a recent 5.4 billion Euro order for new navy vessels from the Italian government, but it also has 26 cruise ships on order, over one-third of the 73 ships now on order around the world. “The European cruise industry has been in the hands of three firms — Fincantieri, STX and Germany’s Meyer Werft, so this merger would reduce the field as huge investments are being made and the sector is going really well,” said Nicola Capuzzo, a reporter at Italian shipping industry publication Ship2Shore.“If military consolidation flows from the Saint-Nazaire deal, it will be thanks to consolidation in the cruise ship industry,” he added.

“Saint-Nazaire is the only yard in Europe with a dock able to build vessels over 300 metres,” said Francesco Tosato, an analyst at the Centro Studi Internazionali. “That is good for the super cruise ships for which there is growing demand, but also makes it strategic for naval industry consolidation.”

A further twist came when the French government began to mull the idea this month of not only holding on to its own 33.4 percent share in the yard, which gives it veto powers, but also introducing state-controlled naval vessel builder DCNS as a shareholder.

“Putting DCNS in as shareholder would create the conditions for naval cooperation between it and Fincantieri, with French government backing,” said Tosato.

“I would be pleased if this deal pushed cooperation between Fincantieri and DCNS,” said Admiral Bisceglie, Italy’s naval procurement chief.

A second Italian analyst said Fincantieri had the credentials to convince France it could be trusted with Saint-Nazaire, pointing to the firm’s takeover of the Marinette Marine yard in the US in 2008, where it has built Littoral Combat Ships for Lockheed Martin.

“The US is mindful of letting non-US firms into strategic industries, yet it felt Fincantieri was reliable,” said Michele Nones, head of the security and defense department at the Istituto Affari Internazionali, a Rome think tank. “It has shown it can control a foreign yard while increasing value,” he added.

Talk of a naval equivalent to Airbus comes at an opportune moment, as the European Union talks up initiatives to create a unified military capability, something which will require greater consolidation among industrial suppliers.

Italy and France have previously built Fremm and Horizon frigates together in joint programs, although they are now competing against each other to sell Fremm frigates in export markets, while a torpedo-related team-up broke down.

Michele Nones said the prospects were not all good for Fincantieri and DCNS teaming again in the short term. “After Fremm, there has been little drive to do another joint program, so there is nothing to build a partnership around,” he said. “They were talking about plans to build a logistics ship together, but the French pulled out,” he said. Italy is building a new logistics ship as part of its large-scale fleet renewal program.

France may also insist on Fincantieri taking a stake smaller than 50 percent in Saint-Nazaire, limiting its control.

But Nones saw room for optimism. “If Fincantieri can take over Saint Nazaire and DCNS takes a stake, it is certainly a step forward,” he said.

Fonte: DefenseNews.com